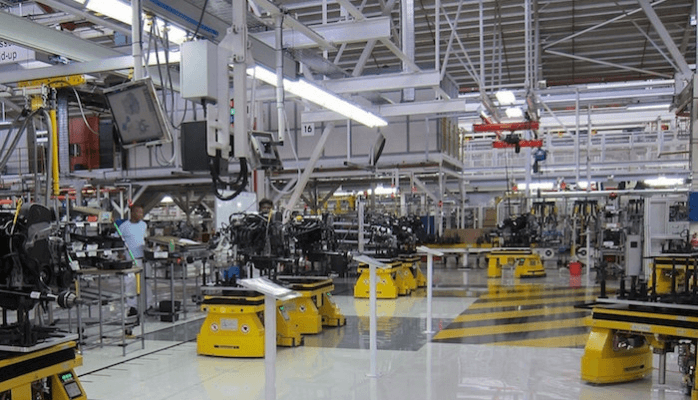

Manufacturers grapple with N272bn unsold goods as inflation bites

Nigeria’s surging inflation rate is making many products unaffordable as manufacturers’ inventory of unsold finished goods rose by 45.4 percent in one year, according to the Manufacturers Association of Nigeria (MAN).

Inventory of unsold products in the manufacturing sector rose to N272 billion in the first half of 2023 from N187.1 billion in the same period of last year, MAN’s latest half-yearly review report released on Tuesday shows.

“This indicates a substantial rise of N84.9 billion or 45.4 percent over this timeframe. However, there was an N11.6 billion or 4.1 percent decline when compared with the inventory value of N283.6 billion recorded in H2 2022,” the report said.

It said the increase in inventory can be attributed to a weakened purchasing power of the consumers, brought about by diminishing real household income resulting from the ongoing escalation of inflationary pressures, compounded by the scarcity of naira in Q1 and the aftermath of the subsidy removal.

When President Bola Tinubu announced the removal of the petrol subsidy on May 29, pump prices surged to as high as N617 per litre from N184, while the value of the naira has plunged following the floating of the currency.

The floating of the currency has increased the official rate from N463.38/$ to N 773.25/$ as at Monday. The gap between the official and black market expanded to N227.

The high cost of dollars and the implementation of a 7.5 percent value added tax on diesel imports have pushed its pump price to as high as N1,200 per litre.

Last month, the country’s inflation rate rose to an 18-year high of 25.80 percent from 24.08 percent in July, according to the National Bureau Statistics (NBS).

Data from the latest Purchasing Managers’ Index, by Stanbic IBTC Bank, shows that high inflationary pressures dropped business activities for the third straight month to 50.2 in August, the lowest in five months from 51.7 in July.

The latest aggregate Manufacturers CEO’s Confidence Index (MCCI) of MAN also shows that manufacturers’ confidence in the economy dropped to the lowest in nearly two years Q2.

The index declined for the third straight quarter to 52.7 points in Q2 from 54.1 points in the previous quarter.

The challenging macroeconomic issues impacted on the manufacturing sector as its growth rate slowed to the lowest in three years.

Data from the NBS shows that the real GDP growth of the sector stood at 2.2 percent in Q2, the lowest since Q2 2020.

The subsidy removal and exchange rate unification policy towards the end of the first half left the economy uncertain, causing a ripple effect that further eroded investors’ confidence, according to manufacturers.

“As a result, businesses and foreign investors are increasingly wary of committing capital, thereby hindering economic growth and prospects for recovery,” they said.

The MAN report also revealed that a total of 3,567 jobs were lost in H1, indicating 1,855 more job lost when compared with the 1,709 jobs lost in corresponding half of 2022 and 850 more jobs lost when compared with 2708 jobs lost in the last half of last year.

“The decline in the number of jobs created in the sector during the period further highlighted the unfriendly business environment resulting from the hasty policies and residual effect of the currency redesign policy that led to naira crunch,” it said.

According to the association, capacity utilisation declined to 56.5 percent from 57.9 percent recorded in the corresponding half of 2022 and cost of funds for manufacturers rose to 24 percent from 22.0 percent in H2 last year.

“The continuous upward adjustments significantly influence the lending rates offered by commercial banks to industries in the Monetary Policy Rate,” MAN said.

Do you want to advertise with us?

Do you need publicity for a product, service, or event?

Contact us on WhatsApp +2348033617468, +234 816 612 1513, +234 703 010 7174

or Email: validviewnetwork@gmail.com

CLICK TO JOIN OUR WHATSAPP GROUP

The association recommends that the challenges in the manufacturing sector should be promptly and effectively addressed.

“The sector urgently requires measures to mitigate the adverse effects of these policies and restore its growth trajectory.”